I wouldn't venture a guess as to when international will out-perform. It could occur in the next 10 years, but nobody really knows.I am clearly suffering from (among other things) recency bias.You may be suffering from recency bias which is why you're describing international stock as "dismal".

I know VXUS is the often recommended international fund, but it looks (to my very untrained eye) to be such a dismal investment -- like, I don't understand why I wouldn't just put more in short term treasuries (1 or 3 year) than in VXUS.

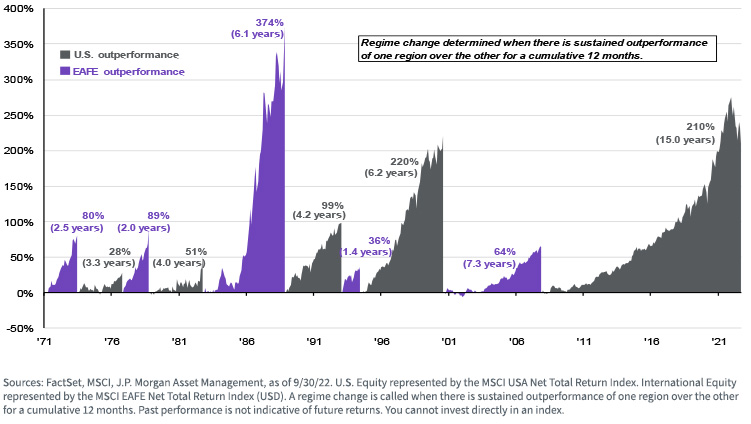

There have been times in the past when international stocks were out-performing the US market, sometimes by a wide margin. I agree that it hasn't happened recently, but since nobody knows when these sorts of trends will reverse the Boglehead approach is to hold your desired allocation to international stocks all the time. Jumping in and out of asset classes is generally seen as a loser's game. See image below.

Regards,

Interestingly, how long should one look back before it is not considered a bias? I'm not trying to be a smart alec. I looks at both VXUS and the MSCI EAFE index here:

https://www.msci.com/documents/10199/82 ... bc9e07b8ba

And neither goes back very far, resulting in data (displayed in the form of graphs) that do not show the cyclical nature of US vs. I'national stock performance.

From your graph it looks like I'national outperformed US from about 2000 to 2008. Before that from 1992 to 1993.

Do you think that, limiting the historial analysis to the past 35 years, and in with the fact of the US outperforming I'national for the past 16 years, it is clear to expect I'national to outperform US in a substantive way sometime in the next 10 years?

As for older historical data (pre 1980s), it's a bit hard to come by since international investing was out of reach, either by high trading costs, or by some foreign markets being inaccessible to US investors. The world of international investing has changed a lot in the past 45 years.

My solution to this (seeming) conundrum is to hold 20% of my equity in international stock. So, for example, if you're a 70% stock / 30% bond investor, then of the 70% in stock, 14% would be in international stock index funds and the remaining 56% would be in US stock index funds.

Maintaining the desired international allocation may require some re-balancing from time to time, so holding your 3 main asset classes (US/International/Bonds) in a tax-deferred account or a Roth account can allow you to re-balance with no tax consequences. Very convenient.

To get a reasonable diversification benefit from international stock investing, 20% of equity is generally the starting point. 30% - 40% would be closer to "market weight" which can serve as a guiding principle.

Regards,

Statistics: Posted by retired@50 — Sun Jun 30, 2024 2:17 pm